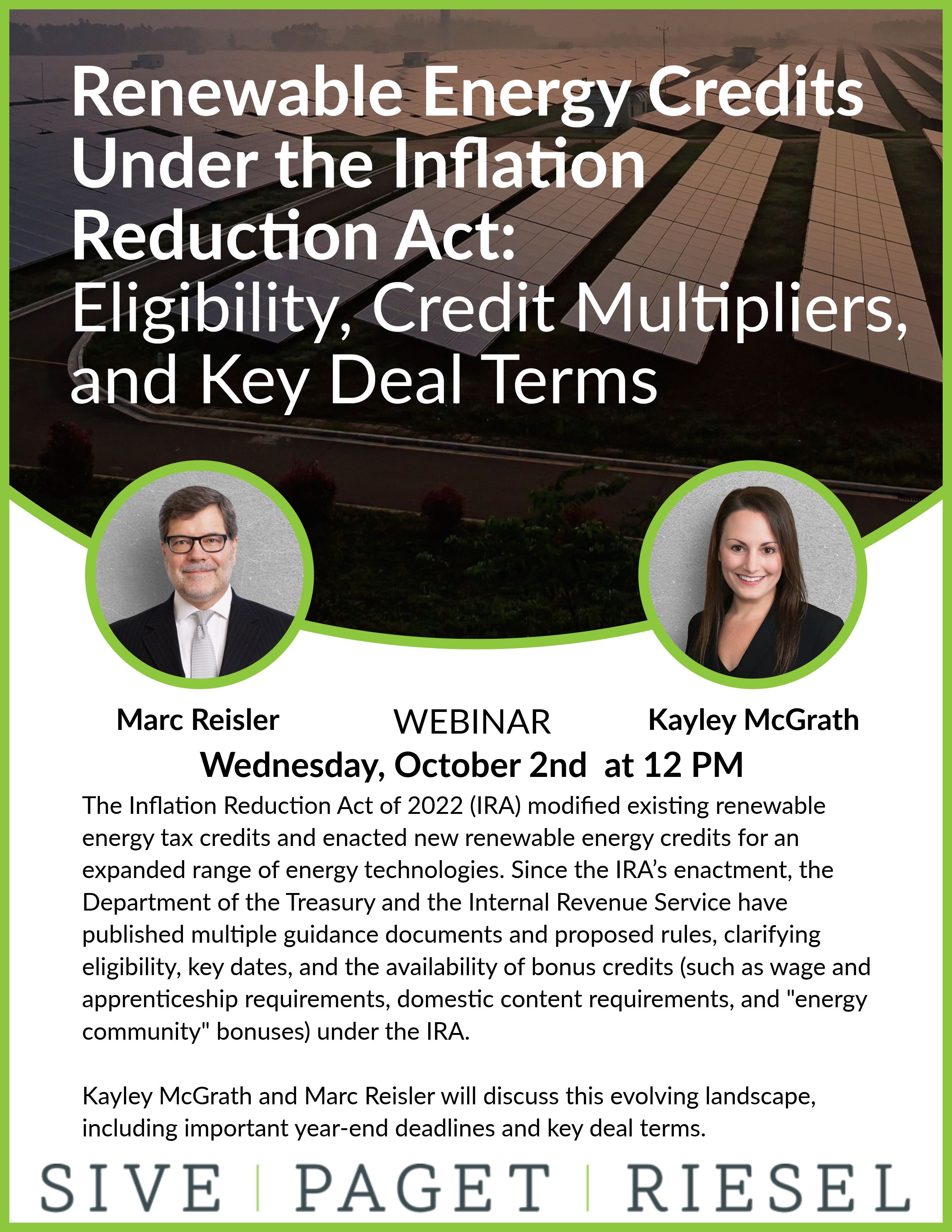

SPR to Host October 2 Webinar: “Renewable Energy Credits Under the Inflation Reduction Act: Eligibility, Credit Multipliers, and Key Deal Terms”

Join SPR for a webinar on October 2nd from 12:00-1:00 PM EDT entitled, “Renewable Energy Credits Under the Inflation Reduction Act: Eligibility, Credit Multipliers, and Key Deal Terms.” Click HERE to register.

The Inflation Reduction Act of 2022 (IRA) modified existing renewable energy tax credits and enacted new renewable energy credits for an expanded range of energy technologies. Since the IRA’s enactment, the Department of the Treasury and the Internal Revenue Service have published multiple guidance documents and proposed rules, clarifying eligibility, key dates, and the availability of bonus credits (such as wage and apprenticeship requirements, domestic content requirements, and “energy community” bonuses) under the IRA.

Kayley McGrath and Marc Reisler will discuss this evolving landscape, including important year-end deadlines and key deal terms.

We hope you will join us! Click HERE to register.

Disclaimer: The content of this webinar, and its supplemental material, is for informational purposes only and should not be considered legal advice. The views and opinions expressed in this program are those of the speakers in their individual capacities and do not necessarily reflect the views or opinions of SPR and/or any of the clients they represent.